Source: The Globe and Mail, Wallace Inmen, 27 November 2017

The world’s investors are checking into Canadian hotels. High occupancy rates and the country’s economic health have contributed to a frenzy of deals.

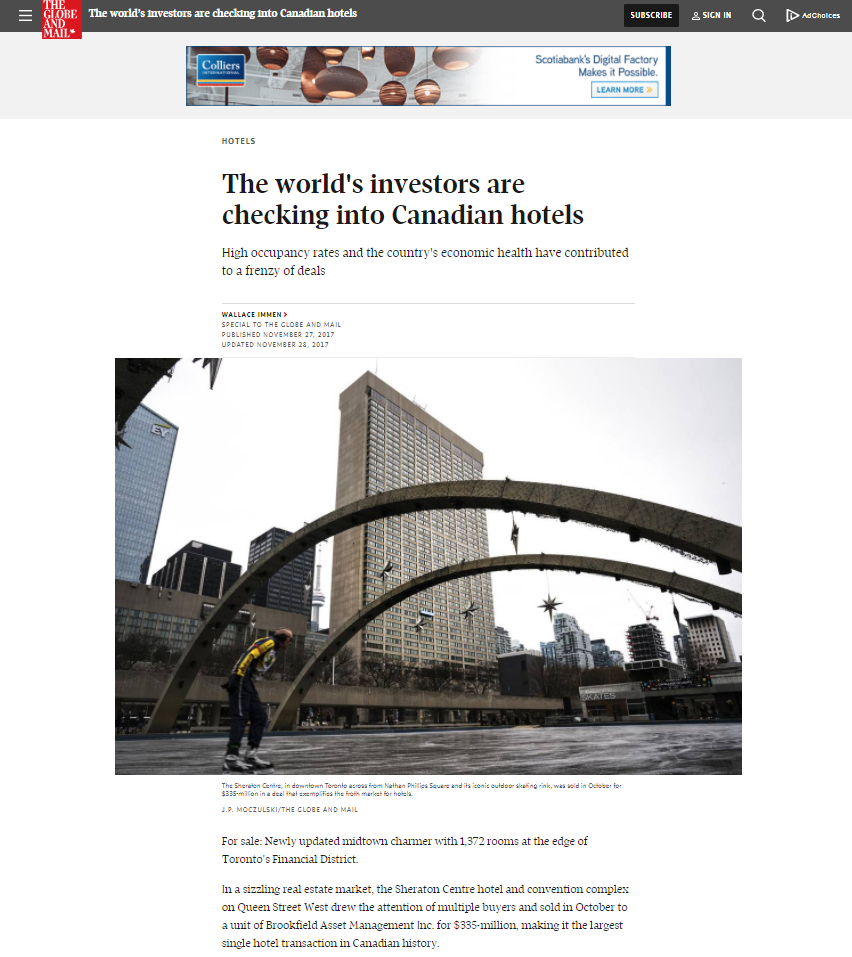

For sale: Newly updated midtown charmer with 1,372 rooms at the edge of Toronto’s Financial District. In a sizzling real estate market, the Sheraton Centre hotel and convention complex on Queen Street West drew the attention of multiple buyers and sold in October to a unit of Brookfield Asset Management Inc. for $335-million, making it the largest single hotel transaction in Canadian history.

The deal is part of a boom in interest in hotels across Canada by equity investors from around the world.

“This has been building over the last three or four years with Canada’s strong economy and GDP growth. As the economy goes, so does the hotel business,” says Bill Stone, Toronto-based executive vice-president for commercial real estate services company CBRE Hotels.

“We are seeing large amounts of capital coming in – a lot of the activity is in Ontario and British Columbia, but there’s an increasingly diverse interest across the country.”

Underlying the trend, the operating performance of hotels has been extremely strong and occupancy rates have been growing much faster than the supply of hotel rooms, says Alam Pirani, executive managing director for the Toronto office of Colliers International Hotels. That has erased price estimates that were standard in the industry.